Goal: 500%+ Returns Every Five Years.

January 2026:

Closed trades from 2025

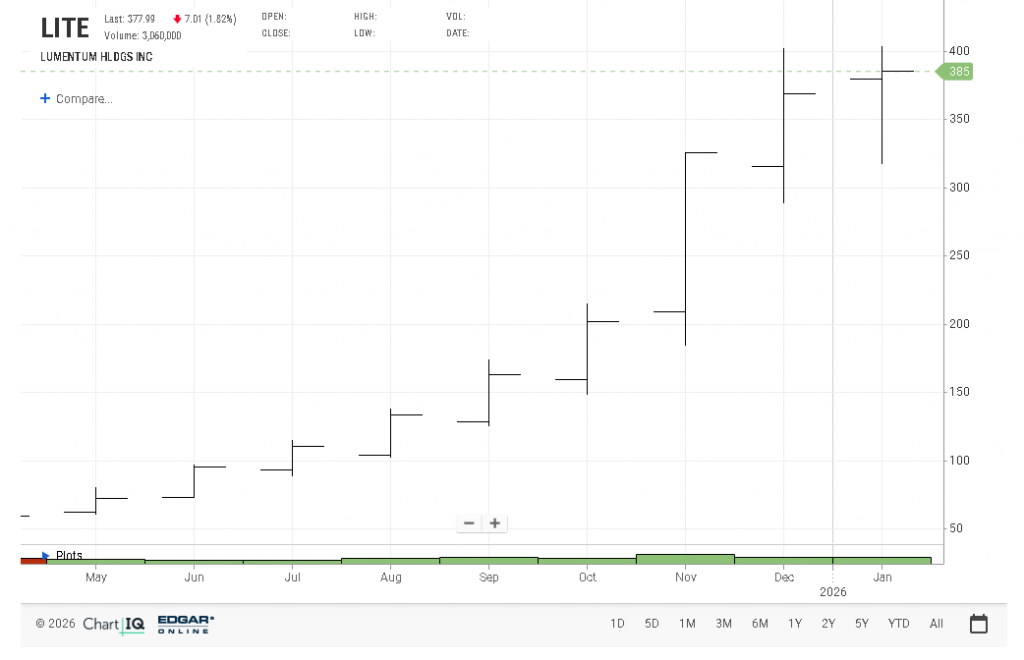

LITE +300%

SNDK +600%

PLTR: +325%

100% rules based Momentum Stock Trading System to enter and exit THE leading stocks in the bull market cycle.

Over 70% win ratio

Long

Typically 5-10 month holding on average

200% – 1,000%+ Gains. That is the “hope” when I get in.

I would suggest holding 4-8 positions. If you want to hit some yearly 100%+ R.O.I’s. Hope for one or two big winning trades. 300%+

Open trades: February 2026

I hold a very aggressive and risky SIX stock portfolio. I want to try and hit some 200%+ years and I am willing to take the risks to get this. A bigger reason is I rarely get over six high quality stocks to invest in. Why diversify for the sake of lowering risk only? Trade with less. THIS DOES NOT MEAN EVERY YEAR is a 100%+. I said “SOME YEARS” There are flat years to factor in as well. Work on an average of 40% -50%+ over five + years.

I can go nine+ months with no new stock to invest in. If you miss the cycle that is it until the next cycle starts. These opportunities do not appear every month. You have to understand how the stock market works. HINT: It’s cyclical. 2-3 good years, 1-2 flat years.

The biggest lesson in stock trading is it is cyclical. Get in too late and you have missed your opportunity for a while. Get in too late and your risk of losses increases. The time to get into LITE, SNDK, WDC was 2025.

“The big money is in the BIG moves” Your stock should have the potential for 300%+ gains. 1,000%+ even better.

Go to a five year+ mindset instead of a one year. Even at 40%compounded over five years the return is 437%

You have to go for the big moves.

They have to be high probability of success moves. If you are simply gambling you cannot win.

AND you have to compound your returns over a few years.

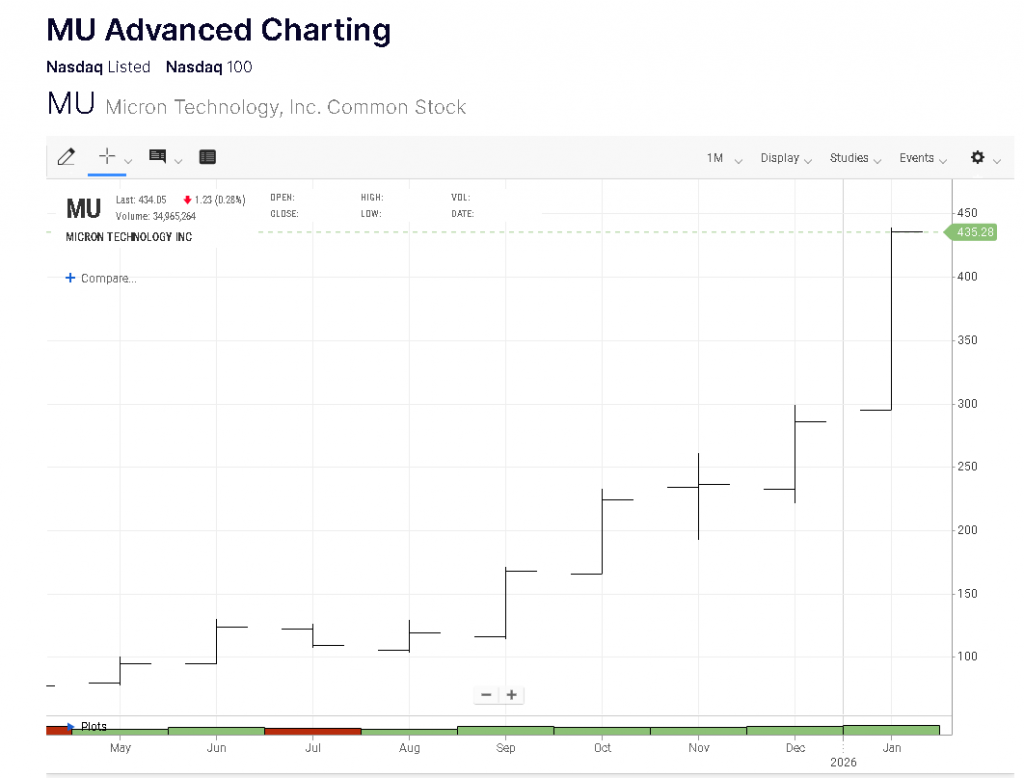

MU:

STX:

CIEN:

WDC:

TER:

No micro management needed or wanted. Once a week monitoring. Watching these stocks every day is not only torture it can lead to emotional trading. Daily/weekly gyrations are random.

All AAA rated institutional stocks.

Closed Trades: Past 24 months

LITE

SNDK

PLTR

APP

ONE HUGE winning trade in a year can mean you make over 100% on your account.

SNDK at over 600% gains meant 100% gains for the six stock portfolio. Only trading this way can you have the chance of hitting “some” 200%+ years.

Think of it more in four to five yearly cycles instead of one year. Because some years will be a lot better than others.

Managed accounts:

RISK 33%

SIX stocks only

——————————————————————————–

Recent Trades:

——————————————————————————-

FAQ:

Send a FAQ to me: rcdwealthltd@protonmail.com

Q) Your stocks seem very high priced?

ANS: Yes. Momentum stocks are. Often $60+ I have no qualms about buying into $200+ stock. NVDA was a great buy at $200+. Look at the stocks we are in now. Many are $300+

It is a huge error by many retail to think the big moves are made only from penny stocks. Take a look at PLTR, SNDK, etc..$50+ stocks that went up a lot.

What is wrong with buying at $200 and selling at $600?

SNDK at $90 was a great buy

LITE at $150 was a great buy

Look for the “almost sure thing, the high probability of success not the long shots.”

Think of it similar to investing in a business opportunity. You would only invest where the chance of success was high (not guaranteed) but very high. It should be the same when you buy a stock.

BUY HIGH..SELL HIGHER has always been much better than buy low sell high.

TOP AAA Rated stocks only

Can these stocks collapse?

Nothing is impossible. EVER. These stocks cannot gap down 40%+ overnight or even worse like many lower price, poor quality stocks can. And yes they can fall. But they do it in a more orderly fashion. They often do correct 25%+

These stocks do go up 15%+ in a day, 50%+ in a month and 400%+ in a year. Amazingly they go up much faster than they can come down. It is false to say high quality, high priced stocks do not have the volatility. They absolutely do. And they are safer than the others that have the same volatility. Check out SNDK, LITE, WDC etc.

Momentum Trading Signals

$2,000 per annum:

IF you have have not had at least 100%+ stocks the next year is free.

BUY the system rules+

3 months coaching on the method (i.e support and email questions answered)

+24 month Trade signals:

$5,000

rcdwealthltd@protonmail.com

Manage money:

$100,000 minimum

Fees 10% of annual profits

I would ask you take a five year+ view and let it compound over years.

** The past does not guarantee the future. There is a risk of losses **